As highlighted in the 2017/18 business plan, the FCA (“Financial Conduct Authority”) are concerned that there may be a lack of transparency, potential conflicts of interest and irresponsible lending in the motor finance industry. They will conduct an exploratory piece of work to identify who uses these products and assess the sales processes, concentrating on whether the products cause harm and the due diligence that firms undertake before providing motor finance.

Since publishing their 2017/18 Business Plan, the FCA have continued their work to identify potential areas of consumer harm in the motor finance market.

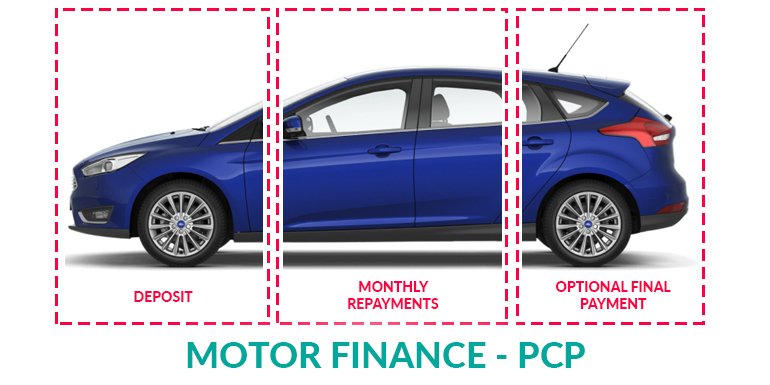

The majority of new car finance is now in the form of Personal Contract Purchases (“PCPs”), a form of Hire Purchase. The key feature of a PCP is that the value of the car at the end of the contract is assessed at the start of the agreement and deferred, resulting in lower monthly repayments.

PCPs provide the flexibility to own the car at the end of the agreement, by paying the deferred value (‘Guaranteed Future Value’, GFV), or to enter into a new agreement, using any equity built up over the course of the existing agreement. The consumer also has the option to simply give the car back, but they will often incur any excess mileage and/or damage costs.

Consumers may also be approached prior to the conclusion of their PCP agreement with the offer of entering into a new agreement, if equity has been built up. The FCA have found that this is a key driver for brand loyalty, which many customers find attractive.

It is the view of the Prudential Regulation Authority that a PCP agreement creates an explicit risk exposure to a vehicle’s GFV for lenders. The FCA considers that direct consumer risk exposure may be more limited, but may be heightened where there has been an inadequate assessment of affordability and/or a lack of clarity for the consumer in their understanding of the contract.

Although PCPs are popular with consumers, they are obviously not the only form of motor finance and remain less predominant in used car sales.

The terminology used in the motor finance market is not universal and may be confusing. The FCA consider it essential that consumers understand the risks and particular features of the motor finance they are taking on.

What the FCA are currently focusing on:

Are firms taking the right steps to ensure that they lend responsibly, in particular by appropriately assessing whether potential customers can afford the product in question?

Are there conflicts of interest arising from commission arrangements between lenders and dealers and, if so, are these appropriately managed to avoid harm to consumers?

Is the information provided to potential customers by firms sufficiently clear and transparent, so that they can understand the risks involved and make informed decisions?

Are firms managing the risk that asset valuations could fall and ensuring that they are adequately pricing risk?

An update is expected by in early 2018 from the FCA.